Founded by a team with deep-rooted expertise in AI

exofinance

The Integrated Intelligence

Platform for Modern Finance

The Integrated

Intelligence Platform for

Modern Finance

Our comprehensive platform unifies advanced AI capabilities with deep financial expertise, deliveringactionable insights for every decision. From risk assessment to investment analysis, ExoFinance transforms

complex financial data into clear, actionable intelligence.

End-to-end workflow integration

Regulatory compliance monitoring

Real-time data processing

Custom model development

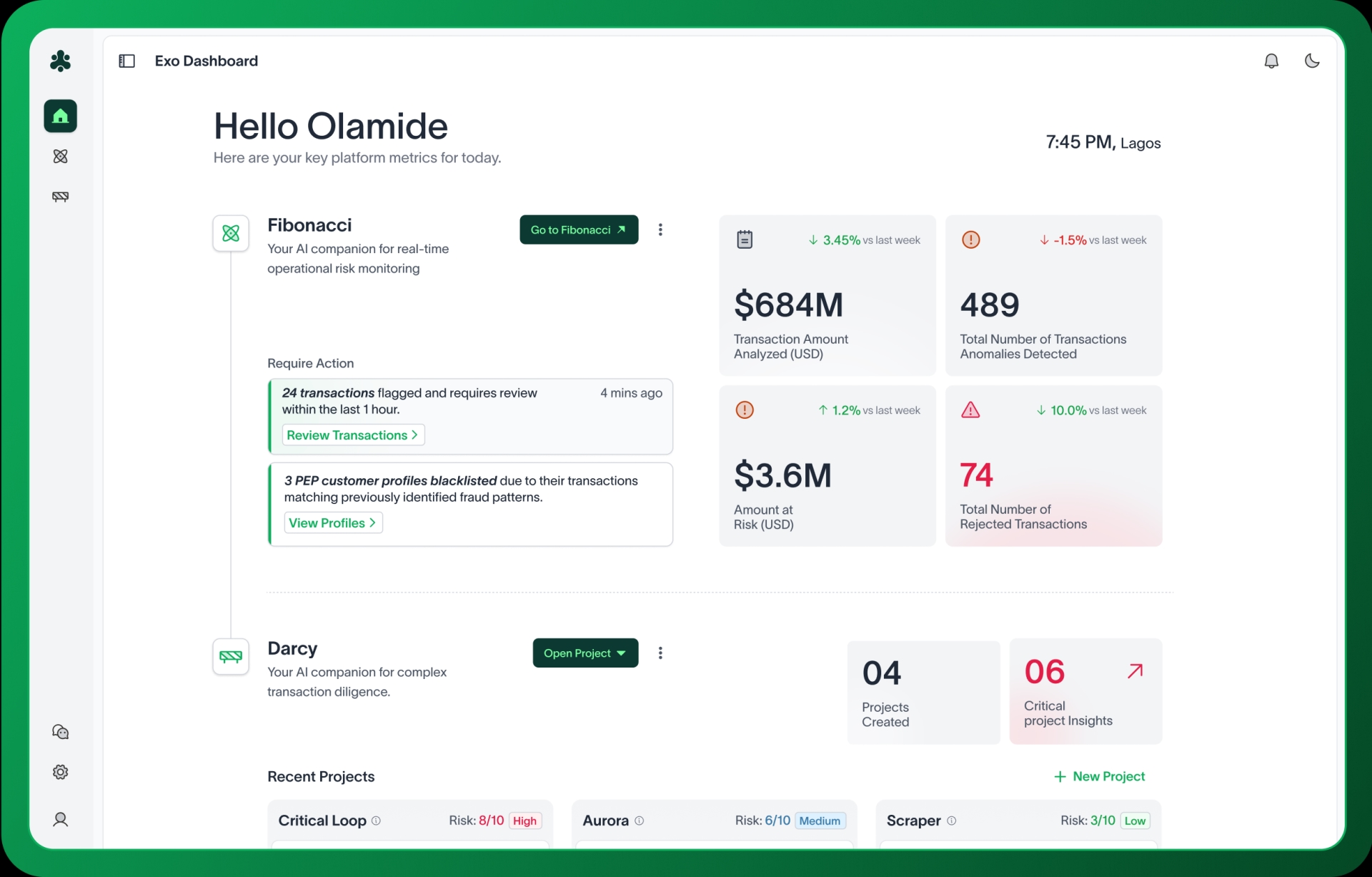

DARCY

Investment

Diligence +

Underwriting

Accelerate your diligence and underwriting with your new Analyst, Darcy.Currently supporting the following asset types.

Commercial Real Estate

Real Estate

Multifamily Assets

Solar + Storage for CRE

Learn More

fibonacci

Advanced Risk

Intelligence

Monitor your transactions, ensure that you are up-to-date with regulatory compliance requirements.Comprehensive transaction monitoring

Regulatory compliance automation

Risk pattern identification

Automated reporting and documentation

Learn More

Industries We Serve

Powering Financial

Excellence

Across

Industries

financial outcomes.